A ‘must have’ for households

As batteries become an indispensable asset in the new solar household, the future of energy independence is looking sunny. On the residential level, a host of drivers, including supportive policies in many parts of the world and surging electricity prices, are driving demand to new highs.

Each year, the global residential battery storage market continues to topple installation records. Despite the appearance of multiple supply chain crunches, prompted by rising raw material costs and rampant demand for electric vehicles, 2022 is expected to be no exception.

Home batteries appear to have hit an inflection point and are poised for bigger things as residential solar and storage becomes a default offering in an increasing number of markets. And some of the first-mover marketplaces have learnings for follower markets.

First movers

In Hawaii, nearly all new residential solar systems are now built with storage; in Germany, about half include batteries, while in Switzerland this figure stands at 15%. In Australia, batteries are being added to around 5% of solar households, according to BloombergNEF. But the analysts say 2022 is poised to see at least two further markets cross the threshold of 50% new solar homes being supplied with storage.

Additionally, there is a rush of battery system retrofits to homes with existing solar in an increasing number of markets. This is driven by a number of things, including declining solar feed-in-tariffs, and homeowners eager to keep excess solar energy for themselves.

But while they have long been a welcome addition to any solar home, battery energy storage systems (BESS) are now becoming an indispensable asset. Against the backdrop of soaring electricity prices across the globe, home batteries hold the promise of greater energy independence, maximizing consumption of self-generated power and putting downward pressure on electricity bills.

In Europe, in particular, prices for electricity and gas have skyrocketed as a consequence of bottlenecks in supply, and already high gas prices at a time when the economy picked up again after lockdowns in the first year of the Covid-19 pandemic. The energy crisis has also been further exacerbated by conflict and instability in the region.

Despite – or perhaps because of – the impact of the pandemic and soaring household energy bills, the forecast for residential solar and storage in Europe is looking bright. Late last year, SolarPower Europe forecast as much as 1.7 GWh of home batteries to be installed in 2022 in its “medium” scenario, while its top of the range forecast was beyond 2 GWh.

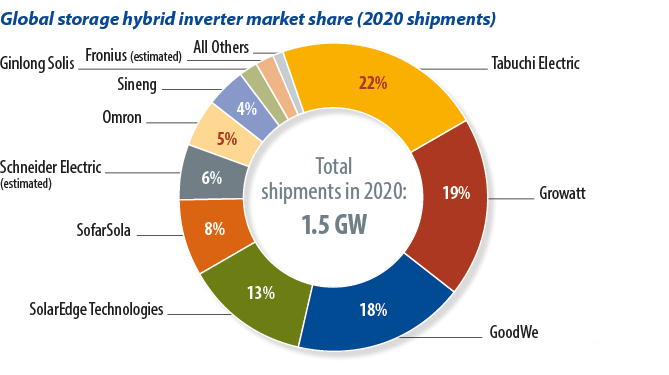

“The soaring electricity prices have fueled a booming demand for residential energy storage in Europe, especially against the backdrop of the Ukraine war,” says Ray Cheng, head of overseas marketing at Growatt. “Moreover, we can see the government incentive policies also act as key drivers of the booming growth in many countries, such as Italy, Spain, etc.”

Backup batteries

In addition to high power prices, power outage backup is another factor driving residential storage around the world. In the United States, for instance, severe weather fueled by the climate crisis has pushed ageing power networks past their limits, with one of the biggest being the 2021 Texas power crisis that left more than 4.5 million homes and businesses without power for days.

Only one year before the Texas crisis, the US Energy Information Administration (EIA) said the average American home endured more than eight hours without power, which is more than double the outage time in 2013, the year that the EIA started keeping track.

With its battery storage solutions that allow powering household loads with or without the grid, Growatt has deepened its market presence in the United States in recent years and set up local service centers. To meet different customer needs, the manufacturer offers two different solutions – Whole Home and Partial Home Backup. With flexible capacity options starting from 6.6 kWh and up to a maximum of 39.6 kWh of energy output, Growatt provides its 3-11.4 kW MIN XH-US residential hybrid energy storage system, with an option to enable whole-home backup both in peak time and blackout.

Clearly, power outages are not solely limited to the United States. Down Under, Australians have endured a number of extreme weather events and bushfires over recent years. Many times, such climate crisis-induced events have left thousands of homes without power for extended periods. On top of that, eco-conscious Australians, who are already leading the world in residential PV installs – with nearly 1 kW of PV installed per person, according to the data from the Australian PV Institute – continue to demonstrate the desire to further reduce the carbon footprint of their own homes.

State government incentives are playing a major role in driving BESS uptake in Australia. In 2020, the South Australian government had to reduce its subsidy to avoid overheating the market and in Victoria, the popularity of home batteries was so high the state government subsidy allocations were exhausted within minutes of each release.

According to the local solar and storage market analyst SunWiz, the residential battery market remained steady in 2021 with 30,246 systems installed. Australia is expected to continue its shift to batteries with one pronounced trend – customers’ growing preference for top-notch products.

With its local subsidiary in Australia established back in 2011, Growatt has emerged as a top brand for residential PV and energy storage markets. “According to our experience in Australia, customers’ preferences always focus on high quality, whole system solutions to prevent maintenance issues, and higher DC overloading to harvest more energy,” says Cheng.

.jpg)